Starten Sie Algotrading Software: Automatisieren Sie Ihre Strategien

Der Bereich "Algotrading" im ATAS Marketplace ist für diejenigen konzipiert, die ihren Workflow mit fortschrittlichen Technologien optimieren möchten. Hier finden Sie Tools und Dienste, die Zeit sparen und einen analytischen Vorteil im Markt mit Algotrading-Strategien aufbauen.

Fertige Lösungen für Ihre Analyse

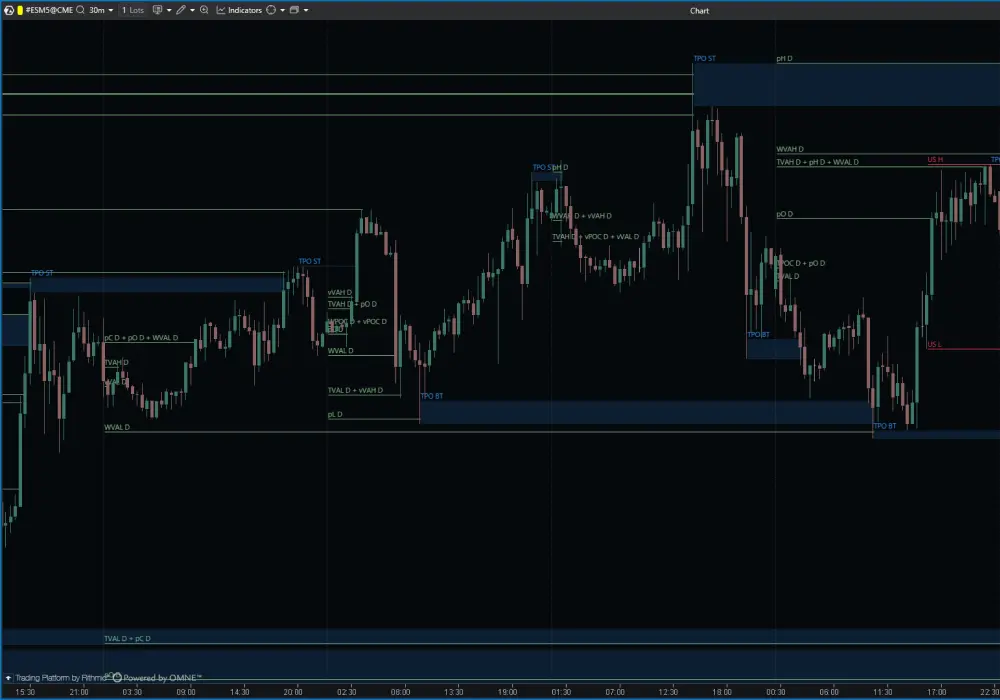

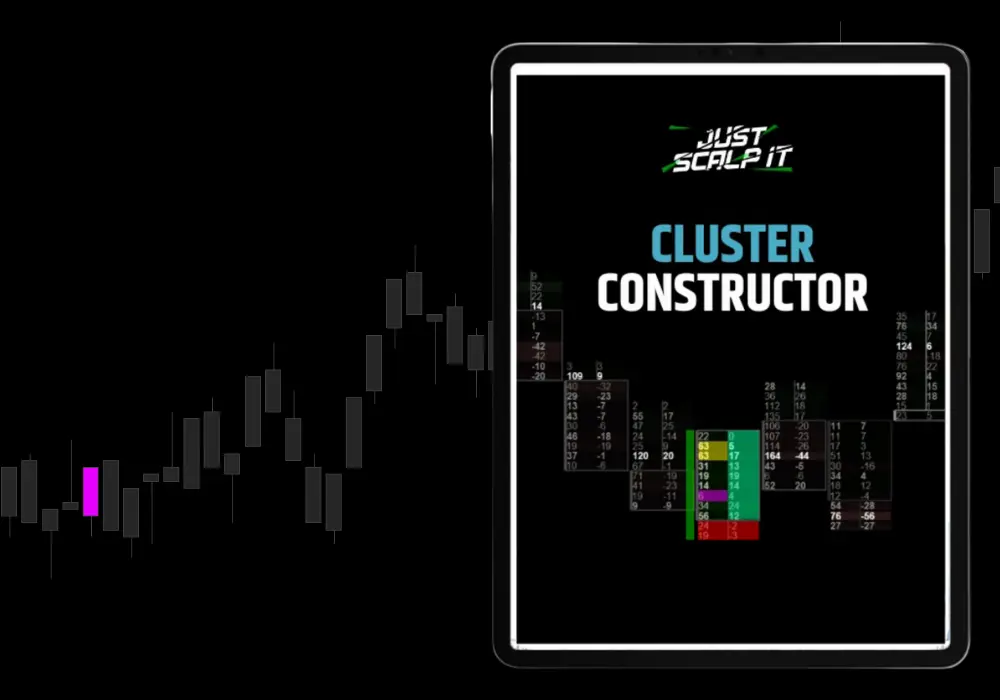

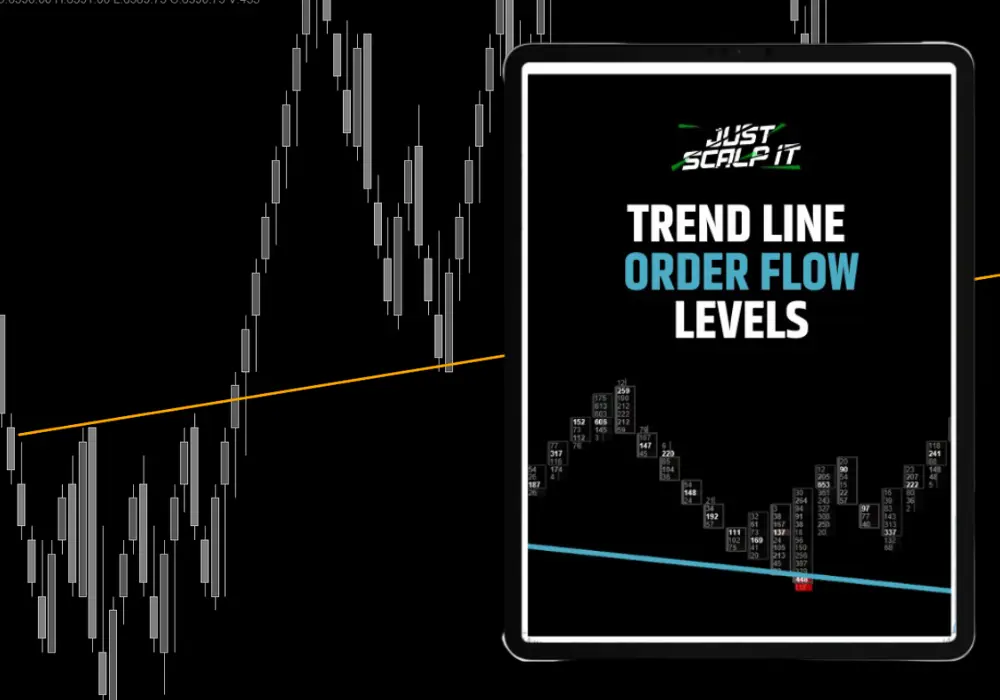

Erweitern Sie Ihr Toolkit mit fertigen Lösungen auf Basis individueller Algorithmen. Entdecken Sie Algotrading-Tools für Krypto, Aktien und Futures — alle nahtlos in ATAS über API integriert. Indikatoren und Trading-Roboter bringen zusätzliche Marktdetails ans Licht und unterstützen tiefere Analysen und konsistentere Entscheidungsprozesse.

Individuelle Entwicklung für Ihre Ideen

Sie haben ein einzigartiges Trading-Konzept, aber nicht das technische Know-how, um es umzusetzen? Nutzen Sie die Entwicklungsdienste von Algotrading-Plattformen, die ATAS-Partner sind. Anstatt Monate in Algotrading-Kurse zu investieren, erhalten Sie direkte Unterstützung von erfahrenen Entwicklern, die einen Algotrading-Bot oder einen Indikator erstellen können, der auf Ihren Workflow zugeschnitten ist.

Algorithmischer Handel ist nicht nur Automatisierung — es geht darum, Workflow-Effizienz freizusetzen. Egal, ob Sie fertige Lösungen wählen oder Ihre eigene Idee zum Leben erwecken, dieser Bereich bietet eine breite Palette an Optionen zur Unterstützung Ihres Handelsprozesses.

Haftungsausschluss: Die Verwendung automatisierter Tools schließt Handelsrisiken nicht aus und garantiert keine Performance. Alle Handelsentscheidungen liegen in der alleinigen Verantwortung des Nutzers.