PiPerium — Trading Performance Intelligence Platform

Piperium sits in the trading ecosystem as a post-execution performance analytics layer, focused on performance metrics, behavioral analysis, simulation, and trader development.

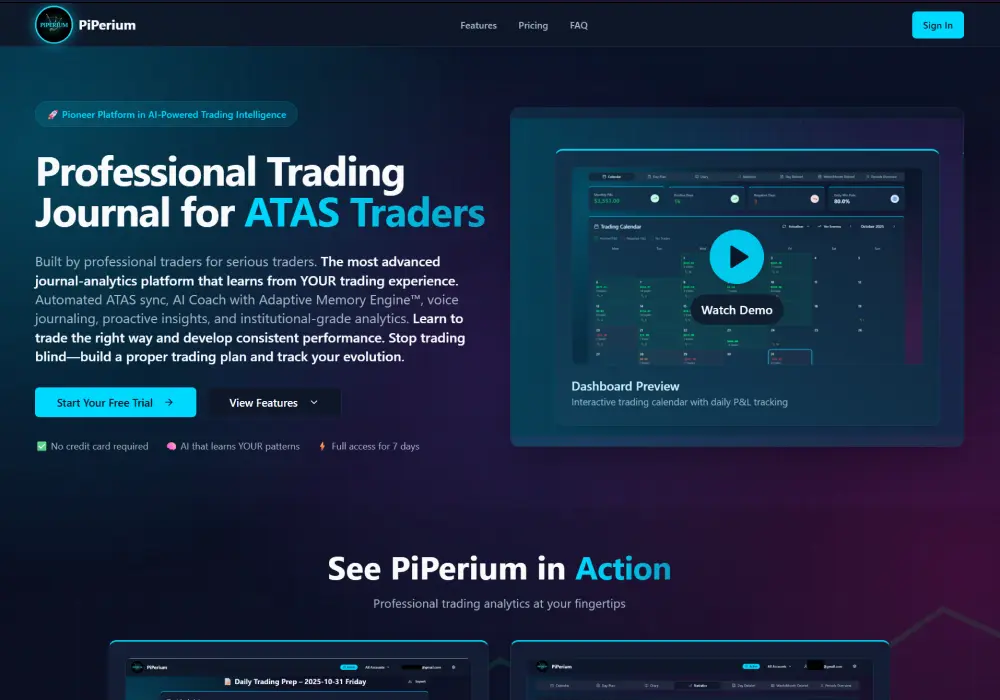

Piperium is a professional trading performance intelligence platform built for serious traders and prop-firm style workflows who analyze their performance to develop long-term consistency. The platform transforms trading data, contextual information, and trader behavior into structured analytics and performance metrics for independent analysis through structured planning, advanced analytics, simulation, and AI-based performance analysis.

Piperium combines structured pre-market planning, detailed trade journaling, and institutional-grade performance analytics:

- MAE/MFE analysis,

- execution efficiency,

- drawdown, recovery metrics,

- time-based performance breakdowns.

Trades are linked to trader intent — such as bias, scenarios, and execution plans — allowing objective evaluation of discipline and decision quality.

The platform includes a powerful scenario simulation engine for analysis and "what-if" testing. Traders can filter data, apply risk rules, exclude specific behaviors, and compare performance scenarios to better understand consistency, risk exposure, and strategy robustness.

At the core of Piperium is an AI-powered analytical feedback system built on the trader's own historical data. Using retrieval-based memory (RAG), the system analyzes real trades, statistics, plans, and debriefs to surface recurring patterns and statistical correlations, which traders use to evaluate their own discipline and performance based on actual historical data rather than generic benchmarks.

Piperium supports voice journaling for trades, plans, and debriefs, significantly reducing documentation friction and improving data quality. The platform also integrates macro-economic context, including central bank events and key economic releases, directly into the trading workflow.

Designed for:

- professional discretionary traders,

- systematic traders,

- performance-driven trading environments

Piperium provides performance analytics and behavioral pattern recognition to support traders in their independent analysis and development process.

Main features:

- Structured pre-market planning and post-market debriefs

- Advanced trade journaling with MAE/MFE and execution metrics

- Institutional-grade performance analytics (drawdown, recovery, time-based analysis)

- AI-powered performance analysis engine using trader-specific historical data

- Scenario simulation analysis

- Pattern library with setup-level performance metrics

- Voice journaling for trades, plans, and debriefs

- Integrated macro-economic context and event tracking

- Automated data imports and synchronization

Piperium integrates with trading platforms through automated CSV synchronization and file monitoring, including native workflows for ATAS users. The platform also supports integrations with external data providers and APIs for macro-economic events and contextual market information, such as the official Treasury department, Federal Reserve Economic Data and links to news providers.

Piperium is a cloud-based web platform accessible through modern web browsers. No local installation is required. Users need an internet connection and supported trade data exports from their trading platform.

Created for retail traders, professional discretionary traders, systematic traders, and prop-firm style trading environments focused on performance analysis, risk management, and continuous improvement.

Piperium stands out by connecting trading data with trader intent, behavior, and context in a single performance intelligence system. Unlike traditional trading journals, it combines structured planning, advanced analytics, scenario simulation, and AI-based analysis built on the trader's own historical data, enabling objective evaluation of discipline, consistency, and decision quality through self-directed analysis.

Users choose Piperium because it goes beyond basic journaling and static analytics. The platform provides a complete feedback loop—plan, execute, analyze, simulate, and develop—supported by institutional-grade metrics, behavioral insights, and AI-powered analysis based on real trading history. This allows traders to analyze their edge, identify recurring behavioral patterns, and independently work on performance development in a structured and scalable way.

PiPerium es una plataforma profesional de rendimiento que ayuda a los traders a mejorar la consistencia mediante diarios estructurados, análisis avanzados, simulación y coaching impulsado por IA. Complementa plataformas analíticas como ATAS al agregar una capa de inteligencia de rendimiento y decisión a cada operación.

- Categoría: Otros

- Idioma: English

Análisis de Trading, Registro Detallado e Inteligencia de Rendimiento. Coaching de Trading y Análisis de Riesgo Impulsados por IA. Software Profesional de Rendimiento de Trading.