Linescope Lite

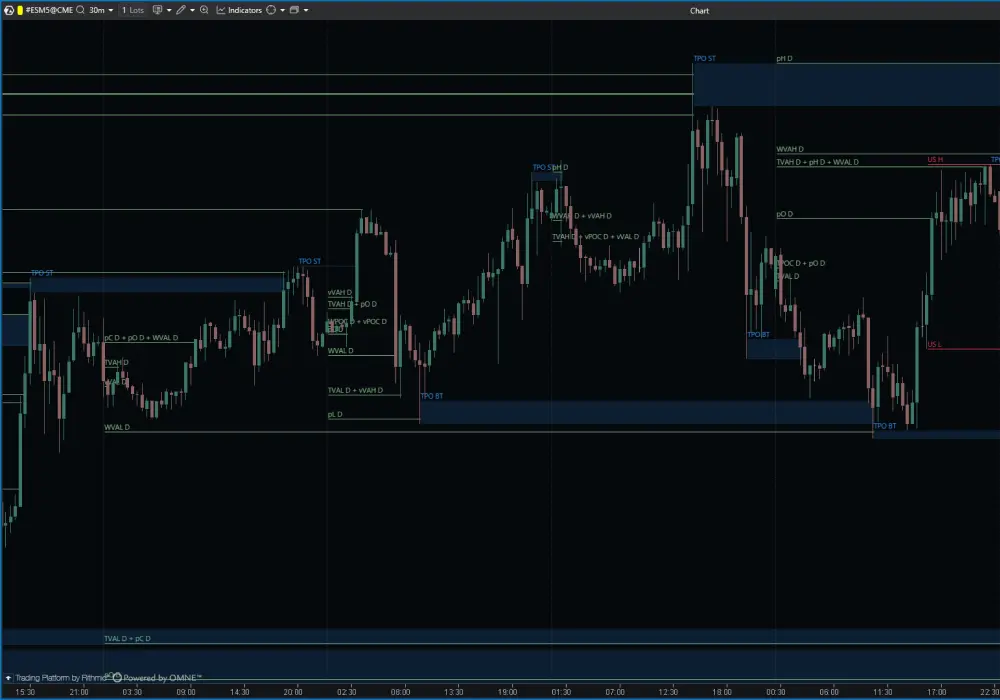

Linescope Lite is a specialized level management indicator that automatically tracks, draws, and maintains support and resistance levels from multiple sources. While it incorporates volume-based analysis as well, its primary function is geometric level management rather than being a pure volume indicator.

A Master-Slave synchronization system that allows users to load extensive historical data on one chart while automatically mirroring all critical levels to ultra-fast timeframes with minimal history. Unlike static level-drawing tools, it intelligently manages level validity by instantly invalidating broken levels and automatically updating all calculations, eliminating the daily grind of manual level management while ensuring 100% consistency across multiple charts and timeframes.

Linescope Lite operates through a sophisticated Master-Slave architecture that simplifies (or even makes it possible) level management across multiple timeframes. The Master indicator is placed on a chart with extensive historical data (can be 100 days, for example), where it continuously scans and calculates critical levels from four key sources:

- Price Action - previous day's Open, High, Low, Close;

- VWAP - Value Area High/Low, Point of Control;

- Volume Profile - VAH/VAL, POC;

- Market Profile - including Buying/Selling Tails.

The system automatically tracks session-specific data for Asia, Europe, and America, creating distinct levels for each trading session along with the current day's developing highs/lows and Initial Balance calculations with multiples (50%, 100%, 150%, 200%). As price action evolves, Linescope Lite intelligently validates each level, instantly removing broken levels to prevent chart clutter while maintaining untested levels that remain relevant.

The Slave functionality allows these calculated levels to be mirrored to any number of additional charts, regardless of the timeframe or historical data limitations. This means that ultra-fast execution charts (such as Range bars, Renko, and tick charts) with only hours or days of data can display weeks or months of calculated levels from the Master chart. Synchronization occurs in real-time using custom sync keys, ensuring all charts display identical, up-to-date level information.

Smart notifications alert traders when price tests any level, while customizable labeling prevents overlap and maintains chart readability. The system runs continuously, updating calculations as new data arrives, eliminating the need for manual daily level drawing while ensuring mathematical precision and consistency that human traders cannot match.

Linescope Lite offers extensive customization options to adapt to any trading style and instrument.

Level Selection & Visibility:

- Toggle individual level types on/off (Price Action, VWAP, Volume Profile, Market Profile levels);

- Enable/disable session-specific levels (Asia, Europe, America highs/lows);

- Control Initial Balance display with customizable multiples (50%, 100%, 150%, 200%+);

- Show/hide today's developing levels vs. previous day levels;

- Broken levels visibility toggle (keep visible until end of trading day or remove immediately)

Visual Customization:

- Individual color schemes for level type and category;

- Adjustable line thickness (in pixels) for different levels of importance;

- Custom labeling system - modify any level name/description;

- Intelligent label merging to prevent chart clutter;

- Font size adjustment for level labels;

- Line style options (solid, dashed, dotted).

Session & Time Settings:

- Fully customizable session times for Asia, Europe, and America;

- Adjustable Initial Balance period definitions;

- Custom start/end times for each trading session;

- Time zone adaptability for global markets.

Notifications & Alerts:

- Audio alerts when price tests any level;

- Customizable sound files for different instruments;

- Visual pop-up notifications with level details.

Master-Slave Configuration:

- Custom synchronization keys for multiple chart setups;

- Extend lines option for full chart coverage at the Slave chart.

Scalping on Ultra-Fast Timeframes:

A scalper trading ES futures on 6-tick Range bars needs critical support/resistance levels but can (or should) only load 1 day of data due to chart speed requirements. Using Linescope Lite's Master-Slave system, they place the Master on a 30-minute chart with 50 or 100 days of history to capture all untested levels, VWAP zones, and previous session highs/lows. The Slave mirrors these levels to the Range bar chart, providing institutional-grade level analysis on a chart that updates every few seconds.

Swing Trading with Multi-Session Analysis:

A swing trader focuses on the ES during American hours but requires context from the Asian and European sessions. Linescope Lite automatically tracks and displays Asia High/Low, Europe High/Low, and the previous day's critical VWAP levels. When price approaches the European High during the US session, the trader receives an audio alert and can prepare for potential resistance, knowing this level was established 8 hours earlier during low-liquidity European trading.

Day Trading with Automatic Level Updates:

A day trader previously spent 20 minutes each morning drawing yesterday's POC, Value Area levels, and session highs/lows. With Linescope Lite, these levels appear automatically and update as market conditions change. When trading oil futures, the indicator shows all the untested levels from the previous day. When the price approaches this level, it's automatically highlighted, and the trader can focus on execution rather than level validation.

Multi-Chart Synchronization for Complex Setups:

A professional trader monitors six different ES charts (5-minute, Range bars, Volume bars, Renko, tick charts, Market Profile). Instead of manually drawing levels on each chart, they use a single Master chart with 100 days of history that feeds all Slave charts. When a critical POC by Market Profile level from 3 weeks ago appears on all charts simultaneously, they can execute trades across multiple timeframes with perfect level consistency.

Professional indicators for the ATAS analytical platform that eliminate confusion and deliver the insights you need to trade with confidence. The only indicators that transform advanced trading techniques into simple, actionable signals, designed for traders who demand clarity, precision, and results.

- Category: Algotrading

- Asset class: Futures, Stocks, Forex/CFD, Cryptocurrencies

⚡ PowerBars automatically spots abnormal volume spikes that signal institutional activity — zero configuration, just drop it on your chart and instantly see when smart money is moving, on any instrument or timeframe.